The Rabid Dogs of Capitalism

Inequality, billionaires and the rise of Thatcher 2.0

Dissolving Economic Landscapes

In a recent appearance on Piers Morgan Uncensored, economist and ex-stock trader Gary Stevenson was challenged by Morgan to give an example of how “massively punishing rich people by massively taxing them has actually benefited the country.” Disingenuously, Morgan couldn’t think of one single example in history. Stevenson cited the example of his own dad who worked for the Royal Mail for 35 years. He said:

“[My dad] Never once earnt more than the average wage in the country. He was able to buy a house, support a family. My parents are retired now. They own their own property. They’re financially secure. That’s not possible now. He lived in an era when the top rate of tax was much, much, much higher. The fifties, sixties, and seventies in the UK.”

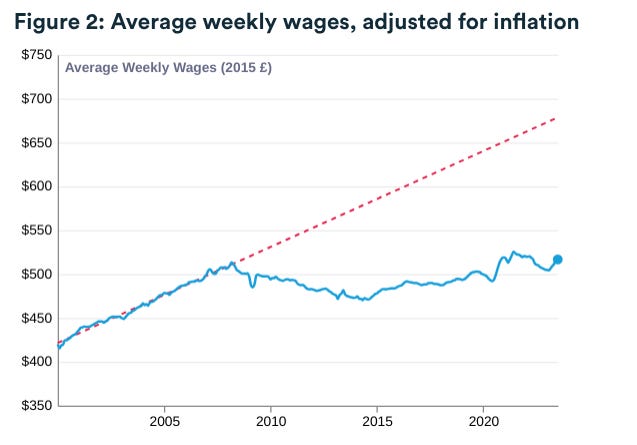

Stevenson’s example will resonate with multiple generations of British people who have endured a significant reduction in living standards due to such things as long-term stagnation in real-terms wage growth and austerity measures. Their parents are likely to have grown up in the post-world war two Fordist period with its affordable housing, stable, long term employment, free university, greater state regulation and welfare provision, industry-focused employment and high union membership. Central to this post-war settlement was a progressive tax system that helped fund public services and reduce inequality; this approach began to be dismantled with the rise of neoliberalism in the late 20th century.

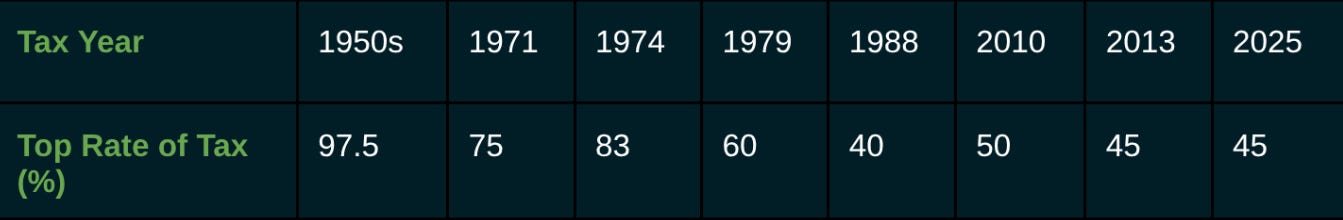

The top rate of tax remained high in the UK until the dawn of neoliberalism under Thatcher when the rate was slashed. The Iron Lady casts a long shadow over 21st century British society as New Labour did little to undo any of her economic policies nor any of her laws against unions. In fact, inequality peaked during Blair’s prime years. The Gini index is one of the most widely-used measures of income inequality and in the following graph it can be seen how income inequality increased as soon as the top rate of tax was reduced.

Make Thatcherism Cool Again

Depressingly in western politics, rather than new ideas, we’ve been seeing a continuation and now even a revival of Thatcher’s ideology; what I am calling Thatcher 2.0. In Argentina, Javier Milei has been professing the benefits of privatisation, cuts to public spending (“shock therapy”), deregulation, and tax reform; The new boss is the same as the old boss. Famously, he wields a chainsaw on stage as a symbol of the cuts he wants to make to public spending.

Trump’s right hand man, Elon Musk, has taken a shine to Milei. At the inauguration for Trump’s second term, Musk was gifted a custom made chainsaw inscribed with the slogan “¡Viva la libertad, carajo!” which translates to “Long live freedom, damn it!”

Neoliberals love to profess their love of freedom but freedom for whom and from what exactly? It is supposed that it leads to freedom in terms of choice, competition and government regulation; everybody is free but some are more free than others. None of those freedoms matter if you’re a worker dealing with insecure jobs, personal debt and income inequality. Freedom from pesky government interference only makes sense to those whose objective is aggressive wealth accumulation with no regard for humanity.

Stevenson went on to predict that we are heading for Dickensian-levels of inequality. The other guest on the show, conservative-libertarian Dave Rubin,pushed back with his assertion that the solution doesn’t lie in taxation but rather in deregulation and a smaller, more efficient state. DOGE. Trump 2.0. Milei’s chainsaw. It’s the same old story! Austerity. Free market economics. What is this madness? We’ve tried it. It didn’t work and now workers are feeling the repercussions as living costs outstrip wages.

Profiting from Crisis

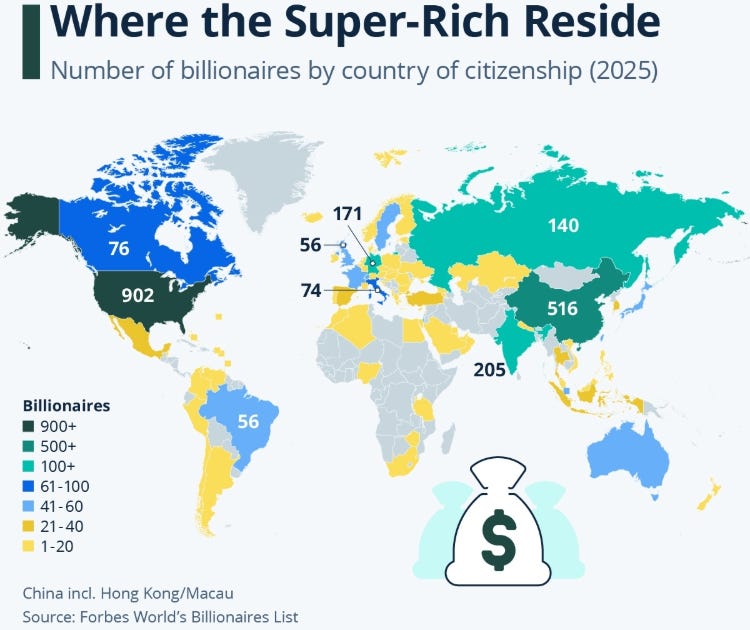

Later in the discussion on Morgan’s show, Stevenson tried to set out his argument that it isn’t about any individual like Musk as, basically, the extreme wealth of billionaires gives them no choice but “to buy up the assets.”

“How rich is Elon Musk? Let’s say he’s worth $300 billion. What’s his passive income? $15 billion a year. What’s $15 billion per week? We’re talking something like $300 million per week. These guys have no choice but to buy-up all the assets. These guys will buy up all of the assets.”

It’s a systemic problem. Just look how many billionaires there are (see below). If wealth accumulation is left to go on without anyone or anything keeping it in check it’s only going to get worse.

In Technofeudalism (2023), Yannis Varoufakis gives an eye-opening description of the extreme amount of wealth concentrated in the hands of three multinational asset management companies known as “The Big Three”. They are BlackRock, Vanguard and State Street. He writes:

“At the time of writing, BlackRock manages nearly $10 trillion in investments, Vanguard $8 trillion and State Street $4 trillion. To make sense of these numbers: they are almost exactly the same as the U.S. national income; or the sum of the national incomes of China and Japan; or the sum of the total income of the eurozone, the UK, Australia, Canada and Switzerland.”

The sheer scale of wealth is staggering. These firms not just investors; They are the dominant shareholders in 90% of the companies listed on the New York Stock Exchange, including household names like Apple, Microsoft, ExxonMobil, General Electric and Coca-Cola.

The 2008 financial crash marked a turning point. BlackRock emerged from the crisis stronger than ever, growing by 156% between 2007 and 2009. That surge was fuelled both by its acquisition of Barclays Global Investors and by its close involvement with the U.S. and UK governments. BlackRock was entrusted to manage and advise on toxic assets using public funds. This is what many describe as “socialism for the rich”. Socialism for the rich, capitalism for the poor.

A similar pattern repeated during the Covid-19 pandemic. As governments injected vast amounts of stimulus money into the economy, luxury spending collapsed. As Stevenson put it:

What you have is basically a massive cash injection from the government through the poor to the rich. Listen, we saw the biggest and fastest ever transfer of wealth and increase in inequality in the history of our nation. And it was immediately followed by an inflationary crisis and a collapse in the cost of living. This is the clearest proof that you’ll ever need of the absolutely bloody obvious fact that if you massively increase inequality you will decrease living standards for working people.”

What links the crash in 2008 and the pandemic isn’t just crisis management, but a systemic pattern in which governments serve the interests of financial oligarchs. Varoufakis’s term technofeudalism captures this well as we are no longer living under classic capitalism, where capitalists take entrepreneurial risks. Instead, we live in a system where wealth and power are entrenched through control of data, platforms, and assets, with ordinary people rendered dependent and powerless; More like peasants than active participants in a functioning capitalist system.

Our Tech Overlords

Billionaires hang around like vultures ready to take advantage of any situation that presents itself. How do you think they got so rich in the first place?! It was interesting to see who attended Donald Trump’s inauguration on 20th January 2025 this year. Below you can see our tech overlords huddled together.

In attendance were (among others): Mark Zuckerberg (Meta), Sundar Pichai (Alphabet), Jeff Bezos (Amazon), Tim Cook (Apple), Shou Zi Chew (TikTok), Sam Altman (ChatGPT), Dara Khosrowshahi (Uber), Rupert Murdoch (News Corp) and even Joe Rogan. It is during this inauguration that Musk twice gave a Nazi salute.

What do they all want? What drives them to want more and more? Is their ultimate parasitic aim to take it all? It’s hard to fathom how those with so much more than everyone else live with themselves. We have to seriously question their motives. Tony Benn would have described all those hangers-on, those vultures circling the corridors of power as “weathercocks”. Blowing in the wind, devoid of a moral compass. On the left there has been a lot of talk about late-stage capitalism or post-capitalism. In my view that’s much too optimistic as it presupposes an end in sight to all this madness. Call me pessimistic but the UK has been under monarchist rule for more than 1000 years; The norm has always been extreme inequality and war. I can’t help but think that those at the top want a return to those Dickensian days that Stevenson alluded to; Shoe shine boys, chimney sweeps and debtors’ prisons. Has this always been the underlying agenda? After the 2008 market crash, austerity policies were pushed on the British people as a supposed necessity. While David Cameron was Prime Minister, his mask slipped in a speech at the Lord Mayor's Banquet at Guildhall in London in 2013. Dressed to the nines in full evening dress while sitting in a gold plated chair, he declared that the cuts to public spending would be permanent. Many had assumed that once the economy had recovered that the public spending would go back up. Not so, as he said:

“We have a plan – and we are carefully implementing that plan. Already we have cut the deficit by a third. And we are sticking to the task. But that doesn’t just mean making difficult decisions on public spending. It also means something more profound. It means building a leaner, more efficient state. We need to do more with less. Not just now, but permanently.”

Cameron’s masked slipped but it was a moment of ideological clarity. Thatcher and neoliberalism never went away as she significantly decreased the tax burden on the rich and they love it. The income inequality has led to a decrease in living standards. We are seeing the results of this now as we experience the emergence of Thatcher 2.0. The richest man in the world standing alongside the US President implementing aggressive Thatcherite policies. For them it’s simple, the state is bad. The state takes away their money. Let’s just ignore the military budget, shall we? Fuck the peasants!

Conclusion: Who Let the Dogs Out?

This article has explored how the ideology of neoliberalism has relentlessly prioritised private wealth over public good. Austerity, tax cuts for the rich, and the hollowing out of the state are not temporary measures—they’re features, not bugs, of the system. As inequality deepens and the state is increasingly stripped for parts, what remains is a society engineered to serve capital, not citizens. Stevenson rightly argues that the problem is structural, not individual. Billionaires act within a framework that rewards accumulation above all else—and when that behaviour goes unchecked, it becomes not just tolerated, but celebrated.

A few weeks ago on his podcast, Bill Burr made a comment about billionaires that went viral. He said that as people can barely afford to pay their bills, billionaires are out there dividing everybody. They’re, in his words, “rabid dogs that need to be put down.”

Bill is spot on. They are frothing at the mouth for more power, more profit, more control. And they don’t care who or what gets crushed beneath them. As long as the system continues to reward their behaviour, they’ll keep hoarding, buying, and bleeding the world dry.

This isn’t just about greed. It’s about power. It’s about control. And it’s about a system that legitimises the domination of the many by the few. As Jodi Dean puts it in Capital´s Grave (2025):

“Ending the domination of the asset holders and tech lords, eliminating the very existence of a billionaire class, is crucial for the flourishing of people and the planet.”

‘Socialism for the rich, Capitalism for the poor’ neo-liberals hate government intervention unless it’s for a trillion/billion dollar company